| |

|

|

| |

|

近期重要財經資訊 |

|

|

|

| |

北市房價指數連 2 跌 高市 Q1 也下滑 【自由時報 / 2023-07-13】

房價跌勢浮現,繼台北市後,今年首季高雄市也開始下跌。根據內政部最新今年第一季住宅價格指數,高雄季跌 1.09%,為台北市外、第二個出現下跌的都會區;台北市則是去年第四季以來、連續兩季走跌。 |

|

| |

|

|

| |

保 2 落空!台經院下修今年台灣經濟成長率 【工商時報 / 2023-07-25】

台灣經濟研究院長張建一 25 日指出,今年上半年民間消費單季增長最高有到 8.5%,支持台灣今年的內需動能與經濟成長;但是上半年因全球終端需求不振,台灣上半年出口、外銷訂單、製造業生產指數等數據均呈雙位數衰退態勢,上半年經濟成長不如預期,加上考量影響經濟的不確定因素仍多,台經院對 2023 年國內經濟成長率預測值為 1.66%,較 4 月間的預測下修 0.65 個百分點。這也是台經院今年來第二度下修該預測值。 |

|

| |

|

|

| |

6 月景氣燈號連八藍 國發會:景氣止跌訊號浮現 【鉅亨網 / 2023-07-27】

國發會今 ( 27 ) 日公布 6 月景氣對策信號,景氣對策信號綜合判斷分數為 13 分,較 5 月增加 1 分,燈號續呈藍燈,連續 8 個月亮起藍燈,但指標轉呈微幅上升,顯示國內景氣止跌跡象略浮現,但成長動能仍偏低緩。 |

|

| |

|

|

| |

Fed 會議紀錄顯示,美通膨風險偏上行,或須再緊縮貨幣政策 【財訊快報 / 2023-08-17】

美國聯準會 ( Fed ) 週三公布 7 月例會紀錄顯示,大多數官員認為,通膨風險「明顯」偏向上行,可能要求 Fed 進一步緊縮貨幣政策。其中,有兩名官員要求 7 月按兵不動,即連續第二次會議暫停加息。 |

|

| |

|

|

| |

CPI 漲幅將達 2.14% 通膨續超越警戒線 【經濟日報 / 2023-08-19】

主計總處昨 ( 18 ) 日舉行經濟預測記者會,下修今年消費者物價指數 ( CPI ) 年增率至 2.14%,較今年 5 月下修 0.12 個百分點,但顯示今年物價情勢仍是超過通膨警戒線。 |

|

| |

|

|

| |

新北囤房稅 9 月上路 【經濟日報 / 2023-08-30】

新北市議會順利三讀通過「新北市房屋稅徵收率自治條例」(即囤房稅),將於 9 月 1 日公告生效,稅額則會反映在明 ( 2024 ) 年 5 月的房屋稅單,持有三戶以內的自住房屋仍維持現行稅率 1.2%,至於持有非自住房屋,依數量採差別稅率 1.5% 至 3.6%。 |

|

| |

|

|

| |

|

近期地上權招標案 |

|

|

|

| |

國產署標出六宗地上權 權利金 7.2 億元 【工商時報 / 2023-08-07】

國產署 6 月 19 日公告第二批 12 宗國有土地招標設定地上權,7 日開標結果共標脫 6 宗,標脫率 5 成,決標權利金總金額新台幣 7 億 2,076 萬元。本次招標設定地上權案地租年息率 3.5% ,其中 1% 隨申報地價調整, 2.5% 依簽約當期申報地價計收。 |

|

| |

|

|

| |

國產署 9 月再釋 14 宗地上權 干城重劃區千坪土地入列 【中央通訊社 / 2023-08-07】

財政部國產署今天表示,今年第 3 批地上權標的預計在 9 月 11 日公告,共 14 宗標的、 7 宗首次列標,且以商業區為主,官員表示,台南市東區逾 1,900 坪土地、已有潛在廠商,台中市東區干城重劃區千坪土地也將入列。 |

|

| |

|

|

| |

今年第二批國有地上權標售 麗寶搶下 3 宗土地 【經濟日報 / 2023-08-08】

今年第二批國有地上權昨 ( 7 ) 日開標,12 宗土地共標脫 6 宗,標脫率 5 成,合計標脫權利金約 7.2 億元。其中麗寶集團共搶下 3 宗土地,再成地上權大贏家。 |

|

| |

|

|

| |

|

|

| |

|

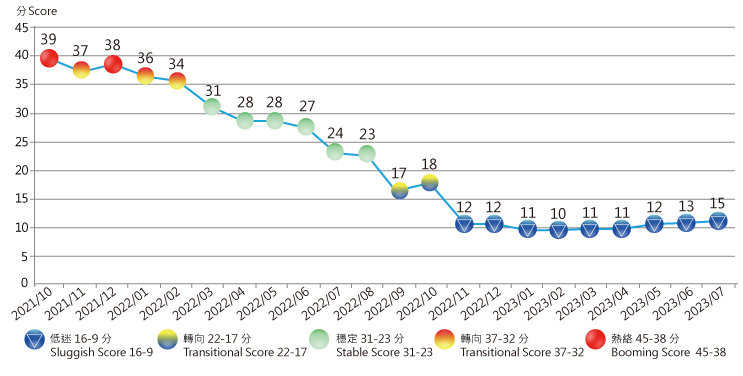

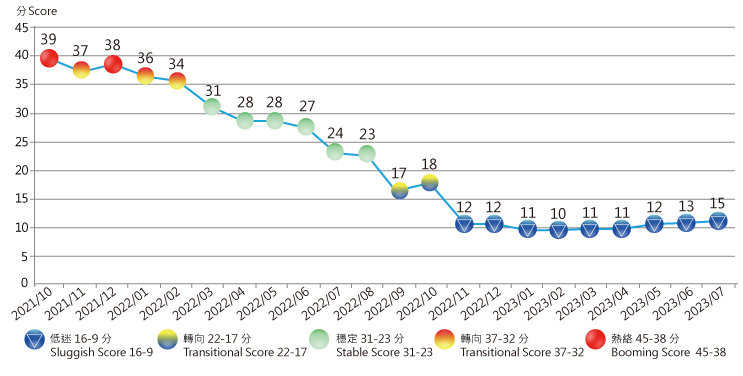

近期景氣對策信號 Business Cycle Indicators - Light Signal & Total Scores |

|

|

|

| |

|

|

| |

- 2023 年 7 月景氣對策信號綜合判斷分數為 15 分,較上月增加 2 分,燈號續呈藍燈;景氣領先指標跌幅縮小,同時指標持續回升,顯示國內景氣雖仍處低緩狀態,但已出現落底跡象。

In July 2023, the comprehensive assessment score for the economic policy signal is at 15 points, which is an increase of 2 points compared to the previous month. The signal remains blue. The leading economic indicators show a reduced decline, with the indicators continuing to rebound. This indicates that while domestic economic conditions are still sluggish, there are signs of a bottoming out.

- 7 月台股交易熱絡帶動金融面指標回升,勞動市場維持穩定,零售及餐飲業營業額持續成長。惟全球終端需求偏弱,致生產面、貿易面指標續呈低迷,但受惠 AI 與雲端資料服務需求增加,跌幅已見收斂,製造業廠商信心亦較上月改善。

In July, active trading in the Taiwan stock market contributed to the rebound in financial indicators. The labor market remained stable, and the retail and restaurant industries continued to see growth in revenue. However, weak global end demand has kept production and trade indicators sluggish. Nevertheless, there has been a convergence in the rate of decline, thanks to increased demand for AI and cloud data services. Additionally, confidence among manufacturing companies improved compared to the previous month.

- 展望下半年,隨 AI 等新興應用推展、消費性電子新品備貨旺季來臨,出口動能可望進一步改善;內需方面,台商回台與綠能投資持續進行,加上淨零與數位轉型趨勢可望誘發企業相關投資,以及政府加速公共建設計畫進度,均有助支撐投資;消費方面,隨疫後國人消費及旅遊需求提升,就業情勢穩定,以及政府鼓勵節能消費,並提出通勤月票及擴大住宅租金與房貸利息補貼等減輕負擔措施,挹注國人可支配所得,激勵消費。整體而言,國內經濟可望逐漸脫離低緩、逐季好轉,惟全球貨幣政策動向及地緣政治情勢發展,仍須密切留意。

Looking ahead to the second half of the year, Taiwan's economy is expected to improve. Factors such as the growth of emerging technologies like AI, strong demand for consumer electronics, and continued domestic investments in green energy and digital transformation are positive drivers. Additionally, government initiatives to stimulate consumption and support infrastructure projects will contribute to economic growth. However, it's crucial to monitor global monetary policies and geopolitical developments for potential impacts on the economy.

資料來源:國家發展委員會,統計至 2023 年 7 月。

Source: National Development Commission, data updated until July 2023.

|

|

| |

|

|

| |

|

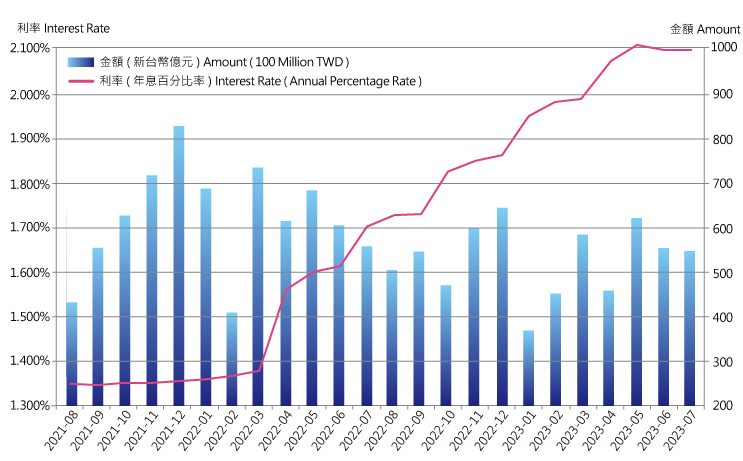

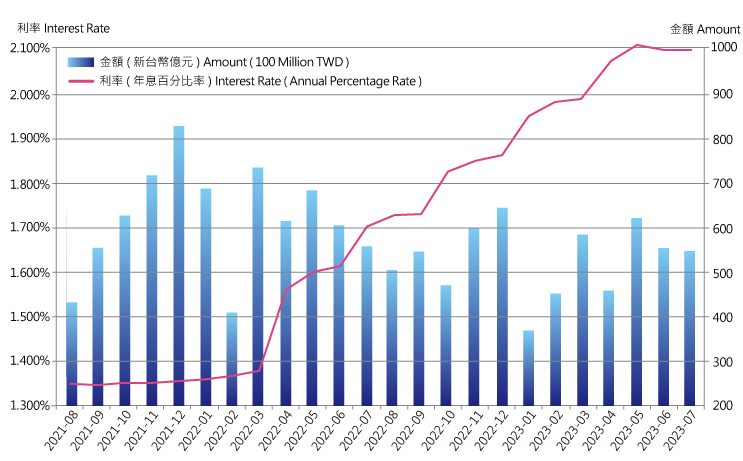

五大銀行新承做購屋貸款金額與利率 Taiwan’s Top Five Bank’s Average Mortgage Rate and Amount |

|

|

|

| |

|

|

| |

- 中央銀行公佈 2023 年 7 月五大銀行新承做放款平均利率。

The Central Bank announced the average interest rates for new loans undertaken by the five major banks in July 2023.

- 本 ( 2023 ) 年 7 月本國五大銀行(台銀、合庫銀、土銀、華銀及一銀)新承做放款加權平均利率為 1.898%,較 6 月的 1.903% 下降 0.005 個百分點,主要係因部分銀行承做利率較高的企業貸款金額減少,使資本支出貸款利率較 6 月下降所致。若不含國庫借款,則本年 7 月五大銀行新承做放款加權平均利率為 1.902%,亦較 6 月的 1.911%下降 0.009 個百分點。

In July of this year ( 2023 ), the weighted average interest rate for new loans undertaken by the five major banks ( Bank of Taiwan, Land Bank of Taiwan, Cooperative Bank, Hua Nan Commercial Bank, and First Commercial Bank ) was 1.898%. This represents a decrease of 0.005 percentage points compared to June's rate of 1.903%. The decrease can be attributed primarily to a reduction in the loan amounts to higher interest rate corporate borrowers by some banks, leading to a decline in the capital expenditure loan rates compared to June. Excluding government borrowing, the weighted average interest rate for new loans undertaken by these five major banks in July of this year was 1.902%, which is also a decrease of 0.009 percentage points compared to June's rate of 1.911%.

資料來源:中華民國中央銀行全球資訊網,統計至 2023 年 7 月。

Source: Central Bank of the Republic of China ( Taiwan ) official website, data updated until July 2023.

|

|

| |

|

|

| |

|

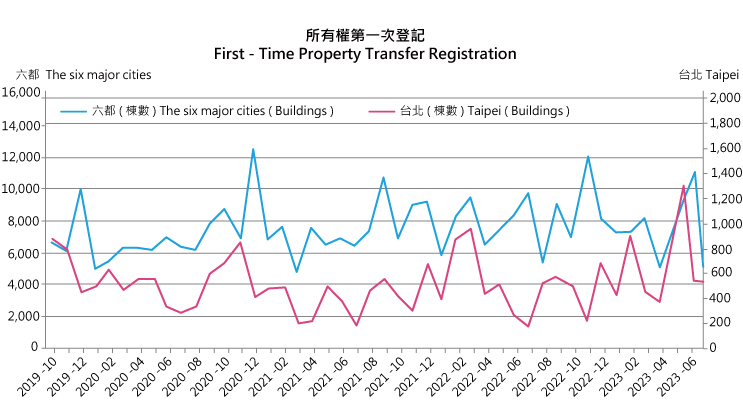

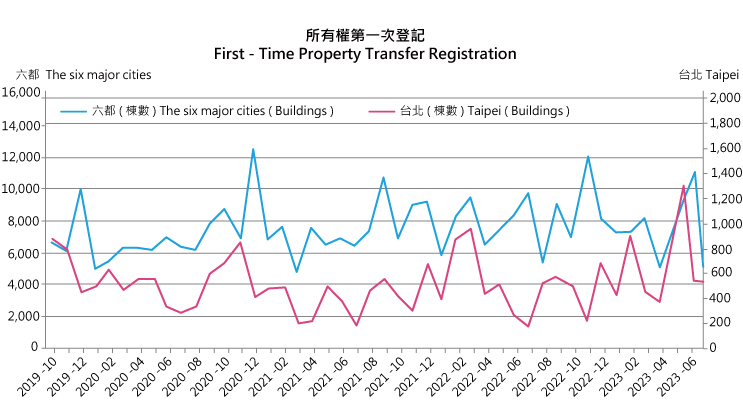

建物移轉登記量分析(所有權第一次) Analysis of Property Transfer Registration �( First-time Ownership ) |

|

|

|

| |

|

|

| |

年份

Year |

縣市

Citiy |

買賣移轉棟數

First - Time Property Transfer Registration |

年變動

Yearly Variation |

變動率

Variation �Rate |

2023年 7 月

2023. July |

六都

Six major cities |

5,869 |

年減↘

Decrease ↘ |

39.27% |

2023年 7 月

2023. July |

台北市

Taipei |

567 |

年增↗

Increased ↗ |

263.46% |

|

|

| |

|

|

| |

|

|

| |

|

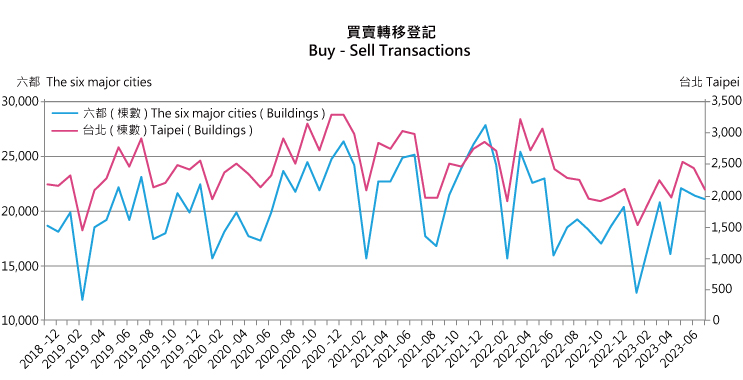

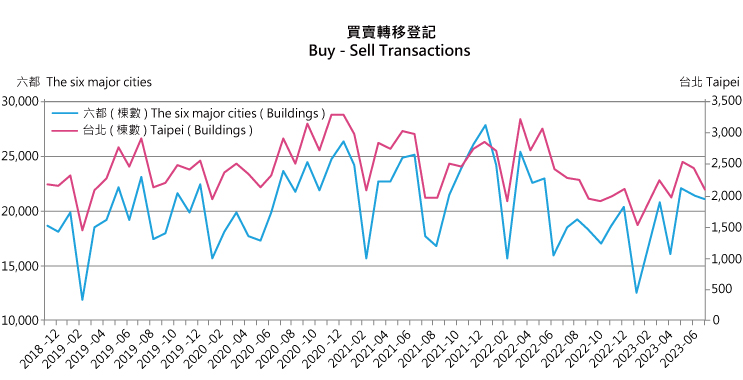

建物移轉登記量分析(買賣) Analysis of Property Transfer Registration �( Buy - Sell Transactions ) |

|

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

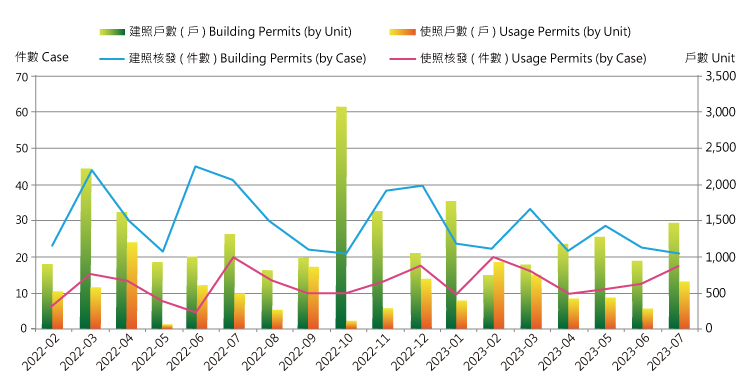

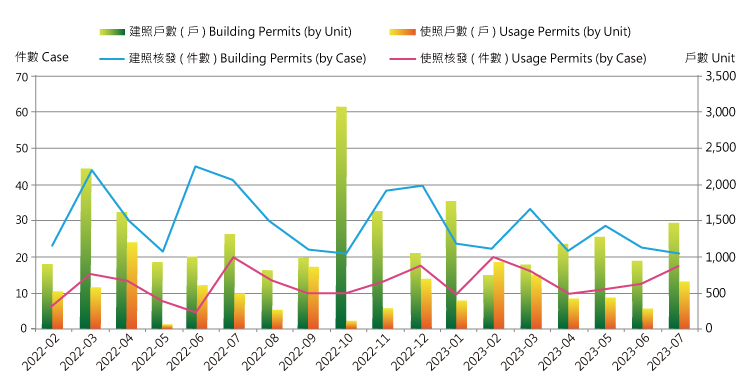

建照、使照量分析 The Number of Building Permits and Usage Permits |

|

|

|

| |

|

|

| |

|

|

| |

- 2023 年 7 月建照戶數較上月增加、使照核發戶數變化較上月增加。

In July 2023, the number of issued building permits increased compared to the previous month, an increase in the change of issued and approved permits compared to the previous month.

- 整體建照、使照及供給戶數整體有逐漸增加之勢,近期供給有大量增加,須持續注意市場變化。

The overall number of building permits, approved permits, and housing supply is gradually increasing. There has been a recent significant increase in housing supply, requiring continuous market monitoring.

資料來源:台北市建管處,因資料發布之時間差,統計至 2023 年 7 月。

Source: Taipei City Building Management Office, data updated until July 2023.

|

|

| |

|

|

| |

|

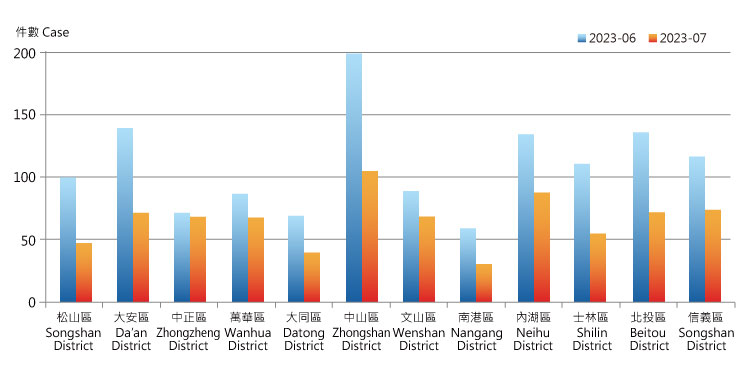

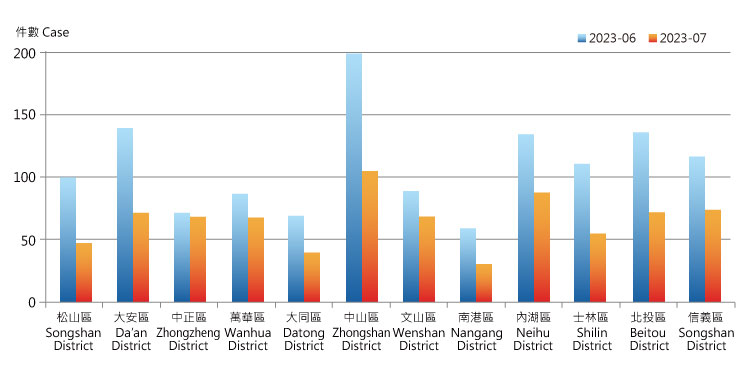

台北市住宅交易量分析 Analysis of Residential Property Transaction Volume in Taipei City |

|

|

|

| |

|

|

| |

- 2023 年 6 月- 2023 年 7 月交易熱門區域為中山區、大安區、內湖區。

The popular areas for property transactions from June to July 2023 were Zhongshan District, Da'an District, and Neihu District.

- 全區市場較為平穩,外部影響因素增多,使台北住宅交易市場放緩。

The overall residential market in Taipei has remained relatively stable. However, external factors have increased, leading to a slowdown in the Taipei housing market.

資料來源:台北市地政局,因資料發布之時間差,統計至 2023 年 7 月。

Source: Taipei City Land Administration Agency. Data is updated until July 2023.

|

|

| |

|

|

| |

|

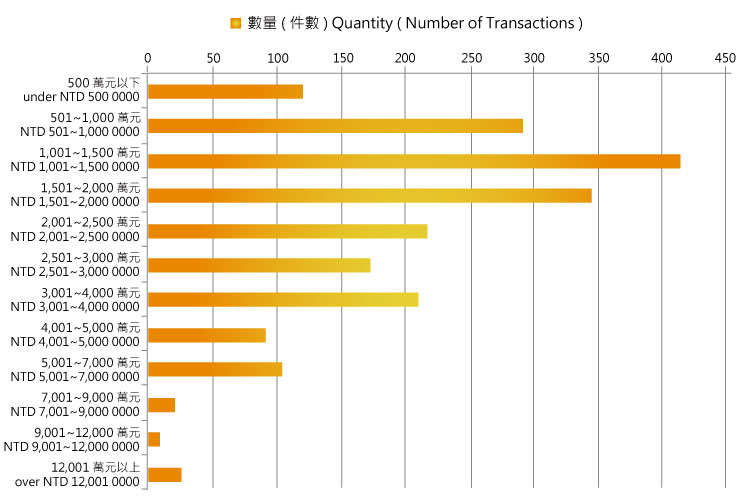

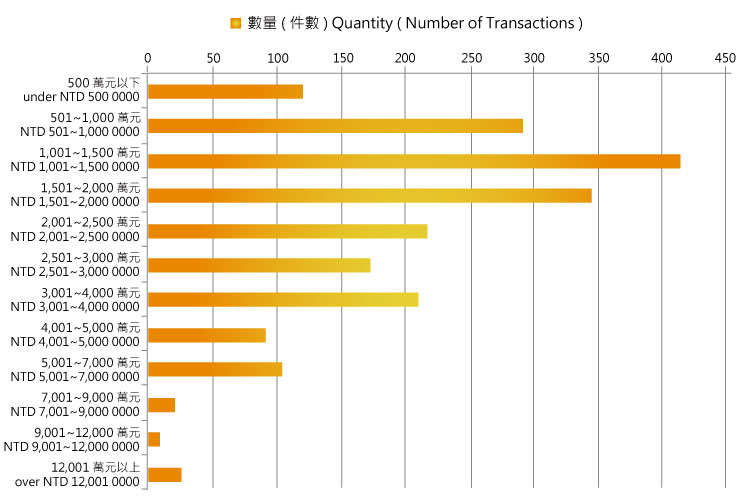

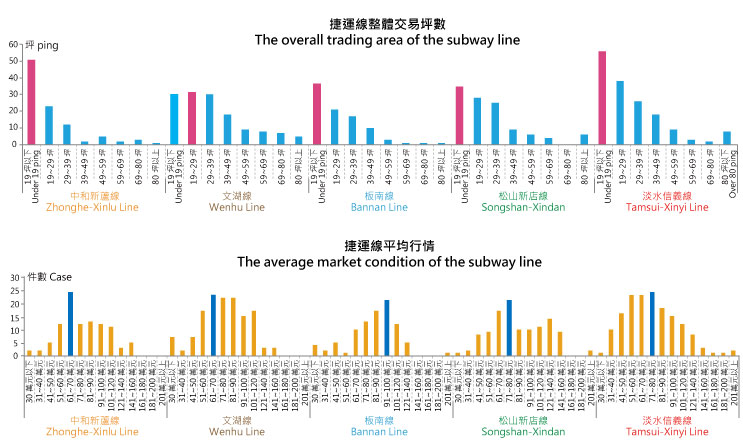

台北市住宅交易總價帶與類型分析 Analysis of Residential Property Transaction Price Ranges and Types in Taipei City |

|

|

|

| |

|

- 2023 年 6 月 - 2023 年 7 月台北市住宅交易雖主要集中在總價 2,000 萬元以內,比例為 57.79%,略為減少。

In June to July 2023, over 57.79% of residential property transactions in Taipei City were priced at NTD 20 million or below, slightly lower than before.

- 1,001 - 2000 萬住宅交易其次,比例持平平穩。

Residential property transactions in the price range of NTD 10.01-20 million were the second most common, with a stable and consistent proportion.

- 4,000 萬以上住宅交易占全市交易 12.52%,高總價交易也呈平穩上揚。

Residential property transactions with prices above NTD 40 million accounted for 12.52% of the total transactions in the city. This indicates a steady increase in high-value transactions.

|

|

|

| |

|

|

| |

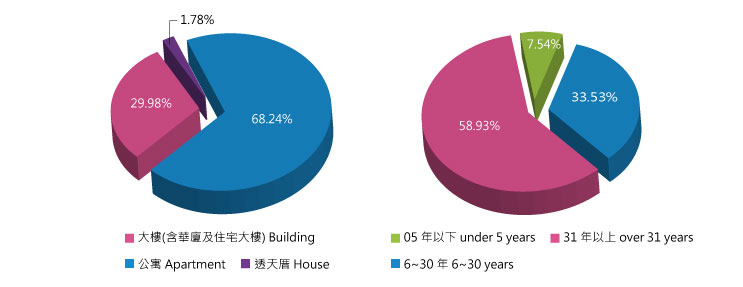

- 2023 年 6 月 - 2023 年 7 月住宅交易產品類型主要集中公寓產品,占比約 68.24%,比例平穩 。

From June 2023 to July 2023, apartments accounted for about 68.24 % of residential property transactions in Taipei City, showing a stable proportion.

- 2023 年 6 月 - 2023 年 7 月住宅交易仍以屋齡 31 年以上為最大宗,占比略增加至 58.93%。

From June 2023 to July 2023, the majority of residential property transactions in Taipei City were properties with an age of 31 years or older, accounting for 59.89% of the total transactions.

資料來源:台北市地政局,因資料發布之時間差,統計時間為 2023 年 7 月。

Data Source: Taipei City Land Administration, Statistics as of July 2023.

|

|

| |

|

|

| |

|

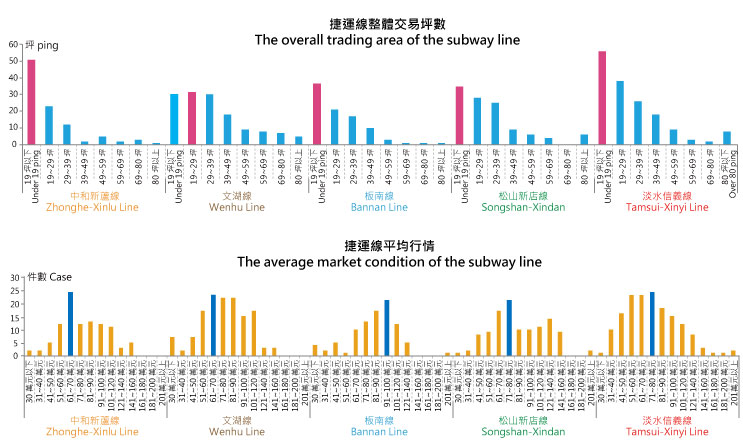

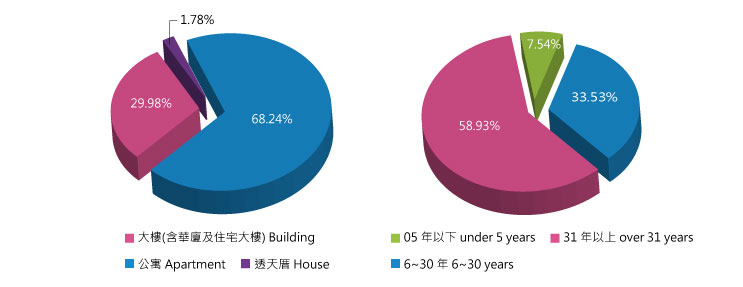

台北市捷運線整體平均行情 Property Overview by Taipei Metro Route |

|

|

|

| |

|

|

| |

|

|

| |

- 近期台北市捷運線週邊住宅平均交易單價區間擴大,且交易有量縮情形,升息影響,市場觀望氛圍浮現,交易也分散,但明顯成交單價持續略微降低,件數略減。

In recent times, the average transaction prices of residential properties near Taipei MRT lines have shown a wider range. Transaction volume has decreased, reflecting a cautious market sentiment due to interest rate increases. Transactions have become more scattered, and there is a slight downward trend in average transaction prices, along with a slight decrease in the number of transactions.

- 近期捷運線周邊住宅交易坪數仍以小坪數為主力。

In recent times, transactions of residential properties near MRT lines have mainly involved small-sized units.

資料來源:台北市地政局,因資料發布之時間差,統計時間為 2023 年 6 月 - 2023 年 7 月,統計資料為捷運站 300 公尺內之實價登錄交易資料。

Source: Taipei City Land Administration Agency. The statistics cover the period from June 2023 to July 2023 and are based on the transaction data recorded within a 300-meter radius of MRT stations.

|

|

| |

|

|